#CHECK MY TURBOTAX CARD BALANCE FULL#

If you can't pay off your balance in full every month, you should avoid paying your taxes with your credit card. When not to pay taxes with a credit cardĭeciding whether it makes sense to pay an extra fee when filing your taxes depends on your card's rewards and your ability to pay it off before the next statement due date. In that case, you won't have the option to pay by credit card through TurboTax just select "pay by check" and proceed to your preferred IRS-approved payment processor to pay your taxes by credit card. You can also use this method if you're preparing a paper return instead of e-filing through TurboTax. While this adds an extra step to your tax filing, it's worth it if you have a large tax bill and you want to pay by credit card with the lowest fees.

Then, once you've e-filed, go to one of the IRS-approved payment processors and use your credit card to pay with a lower fee (1.85% to 1.98%, depending on the processor). When you file your return through TurboTax, choose the "pay by check" option.

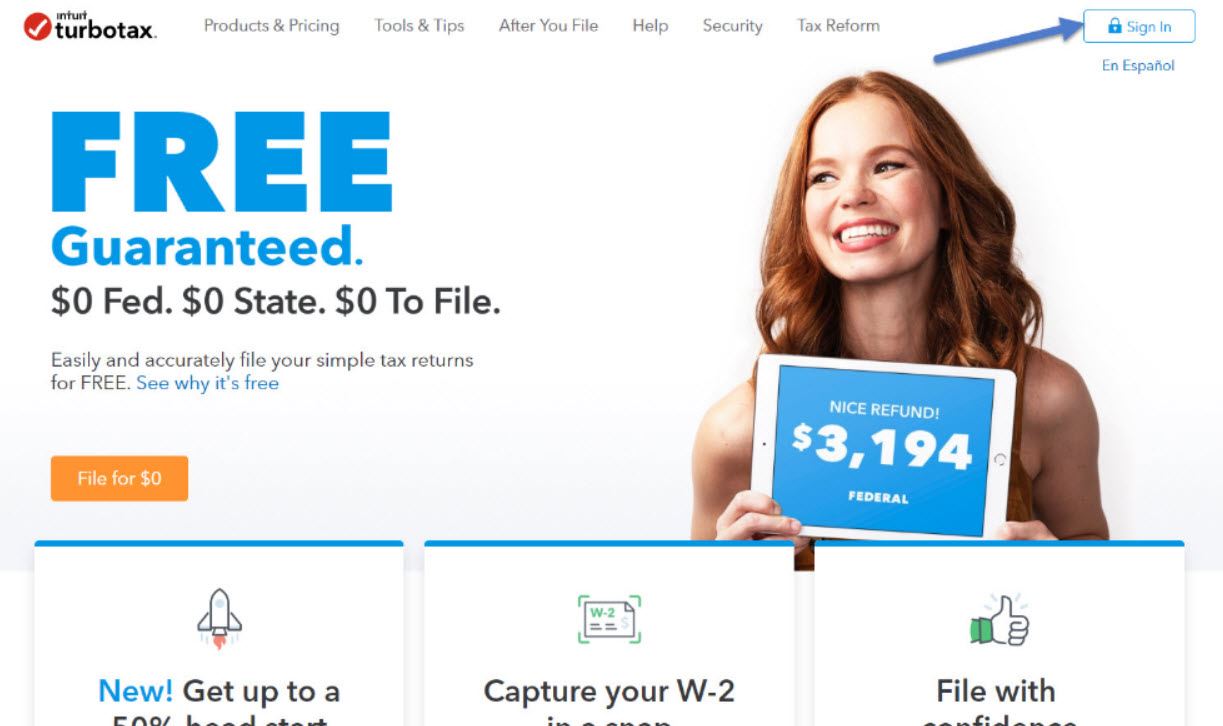

There's a workaround if you'd rather avoid the 2.49% convenience fee TurboTax charges for credit card payments. That's not worth it in most cases, as the fees you'll pay will likely outweigh the credit card rewards you'll earn. TurboTax charges a credit card convenience fee of 2.49% to pay taxes when you e-file. You can also pay taxes with a credit card using tax-preparation tools like TurboTax Tax Software. Paying TurboTax convenience fee with a credit card If you pay your taxes with your credit card when you file online through tax software, the fees typically start at 2.49% but could be even higher. If your tax bill is large, a small difference in the fee could add up to a big savings. That will give you a quick take on how much extra you'll pay when you use a credit card for your taxes. Quick tip: You can click + to open the Payment Processor Fee Comparison table on the IRS website. ACI Payments (formerly OfficialPayments): 1.98% fee with a $2.50 minimum fee.PayUSAtax: 1.85% fee with a $2.69 minimum fee.In most cases, that will be the better option.įor paying your taxes with a credit card through a third-party processor, you'll pay the following convenience fees: There are also options for paying your tax bill with a credit card when you e-file.ĭebit card payments require a small flat fee, but you can just as easily pay your taxes with a bank account transfer for free.

The IRS works with three payment processors to handle tax payments made via debit or credit card: PayUSAtax, Pay 1040, and ACT (ACI Payments) Payments. Does it cost anything to pay taxes with a credit card? Quick tip: The IRS limits the frequency of credit card payments you can make for each category of tax. Some states, cities, and counties allow you to pay income and property taxes with a credit card as well. You can also use a credit card to pay quarterly estimated tax payments, which are most common for people who are self-employed or who have freelance income. The short answer is yes, you can pay what you owe in taxes to the IRS with a credit card. Rates & Fees Can you pay taxes with a credit card?

0 kommentar(er)

0 kommentar(er)